Loss aversion and Prospect Theory

Loss aversion is a psychological phenomenon that refers to the tendency of people to strongly prefer avoiding losses over acquiring gains of equal or even greater value. In other words, individuals tend to feel the pain of losses more intensely than the pleasure of equivalent gains. This bias can have a significant impact on decision-making, particularly in the realm of economics and finance.

Loss aversion was first identified by Tversky and Kahneman in their paper: “Prospect theory: An Analysis of decision under risk”, published in 1979.

This theory aims to explain how people make decisions involving risk and uncertainty, often deviating from the predictions of traditional economic theory, which assumes that individuals are entirely rational and always seek to maximize their expected utility.

On the contrary, Prospect Theory is based on the assumption that our decisions are influenced by emotions, context, cognitive biases, and social norms..

More specifically, Prospect theory introduces the concept of value functions and decision weights to model how people perceive and evaluate potential outcomes in uncertain situations. The theory is built around four main components:

- Value Function: The value function describes how individuals perceive gains and losses relative to a reference point. It suggests that people evaluate outcomes in terms of changes from a reference point (often the status quo) rather than in absolute terms.

- Gains: People are risk-averse when considering gains. As the value of gains increases, the perceived satisfaction or utility gained from those gains diminishes at a decreasing rate. In other words, the psychological impact of gaining $100 is less than the impact of gaining an additional $100 when you already have $200.

- Losses: People are loss-averse when considering losses. The pain or disutility experienced from losses increases at a steeper rate as the losses become larger. The emotional impact of losing $100 is greater than the impact of losing an additional $100 when you’ve already lost $200.

- Decision Weights: Prospect theory also introduces the concept of decision weights, which represent how individuals perceive probabilities. People tend to overweight small probabilities and underweight large probabilities, especially when it comes to losses. This contributes to the phenomenon of probability distortion.

Graphical representation of loss aversion

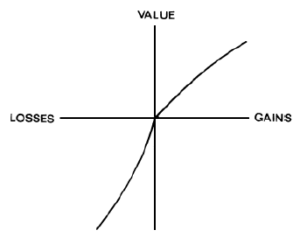

The graph represents the value function of the Prospect Theory, where we can visually understand the notion of loss aversion.

The vertical axis represents the subjective value/ utility that an economic agent perceives, depending on the different outcomes. The horizontal axis represents the outcomes, and whether they are gains or losses. The utility function depicted on the graph is generally concave for gains and convex for losses, which corresponds to the definition of loss aversion.

In other words, the economic agent is more sensitive to losses than to gains. Another property recognizable on the graph is that as the gains increase, the subjective value of the gains does not increase proportionally. Thus, the larger the gain, the smaller is the increase in subjective value.

The opposite is true for losses, the subjective value for losses decreases faster than the actual outcome.

Behaviors induced by the Prospect Theory

Beyond loss aversion, the Prospect Theory can predict other behavioral tendencies that deviate from traditional rational economic behavior:

Risk Aversion for Gains, Risk Seeking for Losses: Individuals are generally risk-averse when facing potential gains but can become risk-seeking when facing potential losses. This contributes to behaviors like selling winning stocks too early and holding onto losing stocks too long.

Diminishing Sensitivity: People’s sensitivity to changes in outcomes diminishes as the magnitude of those outcomes increases.

Framing Effects: The way a decision is framed can significantly influence people’s choices. People often make different decisions based on how a problem is presented, even if the underlying options are identical.

References

Brown, A. L., Imai, T., Vieider, F., & Camerer, C. (2021). Meta-analysis of empirical estimates of loss-aversion. Available at SSRN 3772089.

Kahneman, D., & Tversky, A. (2013). Prospect theory: An analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I (pp. 99-127).

L’Haridon, O., Webb, C. S., & Zank, H. (2021). An Effective and Simple Tool for Measuring Loss Aversion (No. 2107). Economics, The University of Manchester.