Our brain does not like randomness. Randomness is boring. We prefer nice stories.

We have a new job promotion. We have kissed for the first time our new girlfriend. We have won 4 times in the casino. This is our day of chance, we should continue playing (gambler’s fallacy)! This is a much nicer story to tell than just saying that we have had today an accumulation of positive but independent events.

This appetence for story-telling leads us to often take correlation for causality, and to draw conclusion from a limited number of data (small sample bias).

Funds in the luxury sectors have outperformed the last three winters? It means that we should invest in the luxury sector specifically in winter. The top three startups of the year are managed by three cofounders? It means that startups should have three cofounders to be successful!

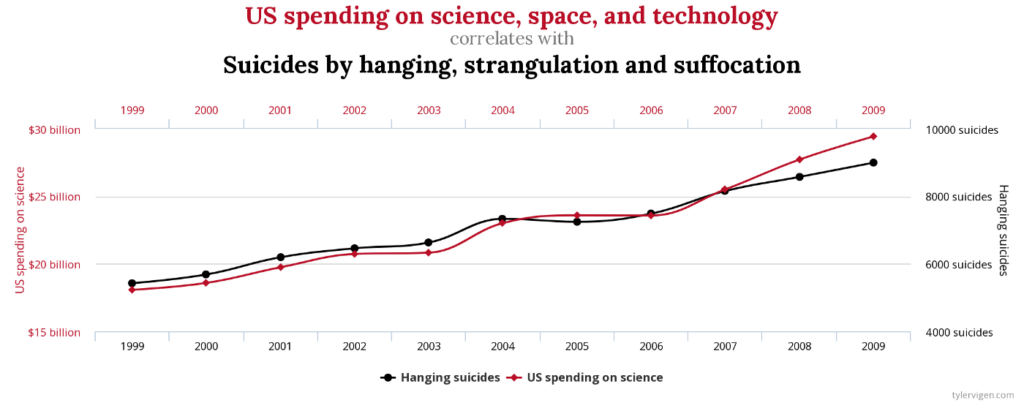

Let’s take the example below of a perfect correlation between the number of suicides by hanging, strangulation and suffocation and… US spending on science, space and technology.

Even if the correlation is nice, there is obviously no causality between this 2 phenomena, even if we are strongly tempted to find a nice story to tell…perhaps the US spending is so depressing that it generates a high level of suicides?

Financial markets cannot always been explained by nice stories

This heuristics strongly influences our financial decisions and leads a number of specific biases.

Gambler’s fallacy

This bias, also known as the Monte Carlo fallacy or the fallacy of the maturity of chances, is the incorrect belief that, if a particular event occurs more frequently than normal during the past, it is less likely to happen in the future (or vice versa), even if the events are in fact independent.

This fallacy is commonly associated with gambling and investing, where it may be believed, for example, that the next dice roll is more than usually likely to be six because there have recently been fewer than the usual number of sixes. In the case of investing, it can be that, since a specific fund has decreased during 6 consecutive days, there is a high chance that it will go up on the 7th day.

Survivorship bias

Survivorship bias is the tendency for failed companies to be excluded from performance studies because they no longer exist. It often causes the results of studies to skew higher because only companies that were successful enough to survive until the end of the period are included. For example, a fund company’s selection of funds today will include only those that are successful now. Many losing funds are closed and merged into other funds to hide poor performance. In theory, 70% of extant funds could truthfully claim to have performance in the first quartile of their peers, if the peer group includes funds that have closed.

Confirmation Bias

This the tendency to search for, interpret, favor, and recall information in a way that confirms or supports our prior beliefs. We are convinced that the luxury sector is highly profitable. Before investing, when we will look at the description of mutual funds, we will only focus on the positive aspects of the description if the fund invests in luxury, and only on negative features for fund which do not. If we do not do so, our global story will be inconsistent…

Rationalization

This behavior is a defense mechanism (ego defense) in which apparent logical reasons are given to justify behavior that is motivated by unconscious instinctual impulses. You have invested in the luxury sectors in the past. You do not remember why. The sector of luxury collapsed. Your relatives tell you that it was not a very good idea to invest so much in this sector.

You may rationalize a posteriori your choice to make it consistent and rational (i.e. to have a nice story to tell). You may explain that this investment was very rational, and that this decrease means than a huge increase will follow soon and make your investment even more profitable

References

- McLaughlin, Brian P.; Rorty, Amélie, eds. (1988). Perspectives on Self-deception. University of California Press.

- Tsang, Jo-Ann (2002). “Moral rationalization and the integration of situational factors and psychological processes in immoral behavior” (PDF). Review of General Psychology. 6 (1): 25–50

- Kahneman, Daniel. Thinking fast and slow.