The popularity of ESG products is well established. According to a recent study, 4 out of 5 investors are looking for investments that are in line with their values[1], while 60% of savers say they are looking for an impact on their investments. Over the last ten years, the green finance ecosystem has become more structured and more and more ESG products have emerged. But is sustainable finance profitable?

The profitability of ESG products throughout history

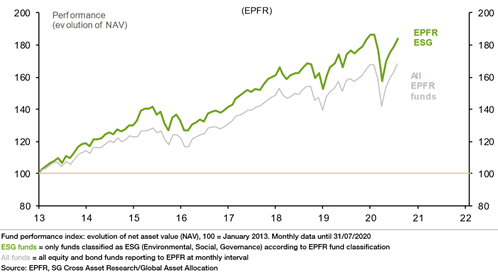

Although the first initiatives in favor of socially responsible investment (SRI) were observed as early as the 18th century through religious groups, it was not until 1971 that the first fund integrating environmental, social, and governance criteria were created, with the birth of the Pax World Fund. The year 2006 marked a turning point, with the consecration by the United Nations of the Principles for Responsible Investment (UNPRI) and the introduction of ESG criteria as we know them today. Since then, the idea that ESG funds perform less well than others have been firmly entrenched in people’s minds. However, a study by Société Générale Cross Asset Research shows that as early as 2013, ESG funds outperformed traditional funds by 16%.

Responsibility and profitability: two complementary concepts in finance

In 2014, a meta-study from Oxford University[2] showed that responsibility and profitability are not incompatible, but complementary. After analyzing more than 200 different sources, this study highlights a correlation between economic performance and sustainability practices. Eighty-eight percent of the sources reviewed showed that companies with strong sustainability practices have better operational performance, which is reflected in cash flow. In addition, 80% of the studies reviewed showed that prudent sustainability practices had a positive influence on investment performance.

ESG products outperformed during the Covid crisis

This outperformance of ESG products has been confirmed by numerous studies. Some players insist that the profitability of green finance is not lower than that of other investments. This is the case of the Morgan Stanley Institute for Sustainable Investment, which conducted a study on more than 11,000 investment funds between 2004 and 2018. According to this work, responsible investment funds even present a lower risk of market downturns, particularly in periods of volatility. An approach that was verified in 2020: ESG products outperformed during the Covid crisis-19[3]. This outperformance can be explained by several factors:

- The strategy of excluding certain sectors and companies that do not meet ESG criteria has made it possible to exclude sectors such as energy and commodities, which have suffered greatly from the various confinements [4]

- By focusing on sustainable companies, ESG funds have overweighted their exposure to sectors that have weathered the crisis better, such as healthcare and technology. [5]

- The Covid crisis revealed the importance of governance and the social aspect: public opinion favored companies that we’re able to support their employees and society in the face of the crisis, and this was reflected in their financial performance.

- Finally, thanks to their sustainable nature, ESG funds have been considered safe havens. In addition, a growing number of investors are interested in investing ethically.

The CAC 40 ESG is more profitable than the CAC 40

Need more arguments for the profitability of ESG funds? To help individuals and institutions direct their investments towards « sustainable » companies, Euronext has developed a new index: the CAC 40 ESG. This index includes the 40 French companies with the best social and environmental practices, based on the SRI label, among the 60 largest companies in the CAC Large 60. The result? Since January 1, 2010, when the index was reconstituted, the CAC 40 ESG Gross Return (GR) has recorded a performance of 190%, i.e., a multiple of 2.9 times the stake and an annualized performance of around 10%. Over the same period, the « classic » CAC 40 has only performed by 140%. Regardless of the period, the CAC 40 ESG outperforms the CAC 40. This is enough to reconcile investors of all backgrounds, regardless of their appetite for sustainable finance: far from being a brake on performance, ESG criteria make it possible to be more profitable.

Green finance: an inevitable transition?

For some, the transition to green finance is inevitable anyway. As James Gorman, CEO of Morgan Stanley points out: « If we don’t have a planet, we won’t have a very good financial system. Philip Hildebrand, the vice-chairman of BlackRock, agrees, explaining that we must stop comparing the profitability of sustainable investments with traditional investments: « We must get out of this paradigm, which is based on a fictitious comparison. If we don’t do anything about the climate, scientists tell us that we will lose 25% of our economy in the coming decades. The comparison of sustainable and unsustainable investments is a false comparison. We don’t have a choice anymore anyway, » he explained at the Common Good Summit 2021.

Green finance: what role for financial institutions?

Now that green finance is no longer a niche reserved for a few virtuous investors, but a source of profitability for all, financial institutions have a dual role to play. They must:

- Educate their clients on sustainable finance, by showing them that it is now possible to be profitable and by listening to their expectations.

- Provide the means to know precisely what their clients expect in terms of sustainable finance, to offer them ESG products adapted to their values.

This is the raison d’être of InvestProfiler, an interactive questionnaire based on behavioral finance that assesses investors’ preferences regarding sustainable finance. Developed by Neuropofiler, the InvestProfiler allows to precisely understand the impacts investors are looking for and to identify the sectors they wish to exclude. In addition to meeting MiFID II and DDA regulatory obligations, InvestProfiler is an excellent opportunity to boost your clients’ savings: once their investment profile has been identified, you can easily recommend them the most suitable financial products! Would you like to know more? Request a demo!

[1] Natixis Investment Managers

[2] “From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance”

[3] ESG funds beat out S&P 500 in 1st year of COVID-19; how 1 fund shot to the top – S&P Global

[4] Coronavirus: How ESG scores signalled resilience in the Q1 market downturn, Axa IM (March 31, 2020)

[5] ESG funds continue to outperform wider market, Financial Times https://www.ft.com/content/46bb05a9-23b2-4958-888a-c3e614d75199