Being at a personal or at a professional level, financial decisions are made every day, big and small, simple or complex. Financial decision-making is a daily exercise and every single decision has an impact, from the slightest to the biggest. Naturally, a basic knowledge in finance helps making the most suitable financial choice. Indeed, financial knowledge has an impact on financial vulnerability and a greater financial knowledge enhances financial resilience. Hence, financial resilience is linked to financial education which has a direct impact on financial vulnerability.

Studies show that the level of financial education and financial literacy are very heterogeneous among people. The most vulnerable people in financial literacy are vulnerable by themselves: low income, unemployment etc.

The least financially educated the people are, the less they are able to make the most suitable financial decisions. Some groups of people are thus more vulnerable than others. Those identified vulnerable groups appear to be the least financially resilient and the most fragile financially wise. Indeed, studies show that households income and financial literacy are also linked.

The European Supervisory Authorities: the European Insurance and Occupational Pensions Authority (EIOPA), the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA) jointly held a conference with the aim of exchange views on the importance of financial education and literacy in the EU and provide concrete solutions to foster financial literacy of consumers.

Financial knowledge

Financial knowledge is an important component of financial literacy for individuals. It helps them make appropriate and well-informed financial decisions. A basic knowledge of financial concepts and the ability to apply numeracy skills in a financial context ensure that consumers can navigate with greater confidence financial matters and react to news and events that may have implications for their financial well-being.

Financial knowledge is essential on everyday life to make choices, as a consumer, as a professional, to pay the bills, to borrow or to save money, and to invest for example. To a higher scale, financial knowledge is really important to learn to achieve financial growth and success.

Financial literacy is made of 5 components:

- Earn money: salary, various earnings (real estate…)

- Spend: how to spend money in the most suitable way and what is the limit amount to spend depending on the available monthly incomes?

- Save and invest: allocation, if possible, of a proportion of the monthly revenue to be saved in order to constitute a financial cushion and ideally invest through financial products that are suitable in order to make profits on the savings

- Borrow: borrow wisely and avoid toxic loans with higher interests rates

- Protect: always make sure that the financial situation is (as much as possible) secured by contracting the appropriate insurances for example.

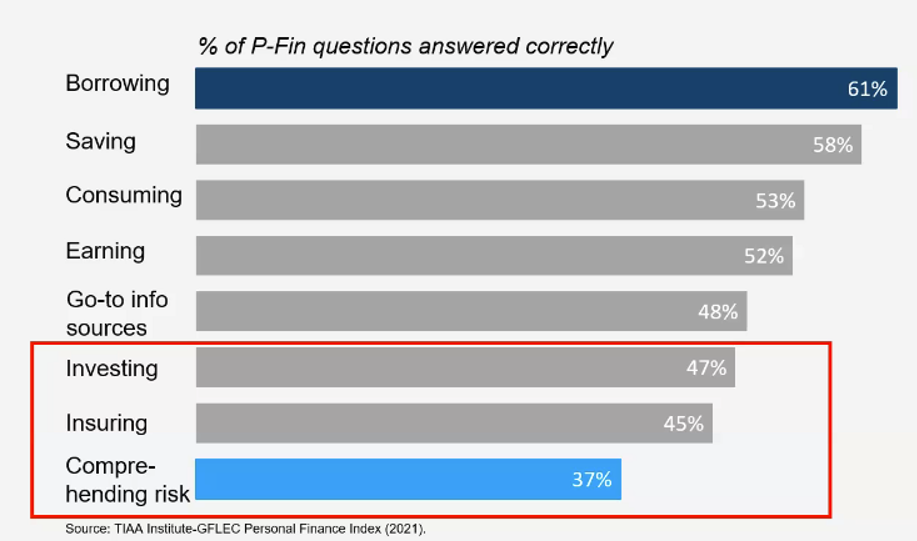

The P-Fin index (Personal Finance Index) of the TIAA Institute GFLEC (Global Finance Literacy Excellence Center) measures functional financial knowledge and understanding that enable sound financial decision making and effective management of personal finances among U.S. adult persons.

The survey is made of 28 questions across 8 functional areas: earning, consuming, saving, investing, borrowing/managing debt, insuring, comprehending risk, and go-to information sources. It gives a very clear overview of the impact of financial literacy on financial resilience. The results are quite interesting and show that financial knowledge is highly unequally distributed between the different investigated areas. For instance, surveyed people have more knowledge about borrowing than about comprehending risk (61% vs. 37% of questions answered correctly).

This significative difference could be explained by the fact that people are more familiar with borrowing money than with being in a situation of risk exposure if investing in a given financial product, merely because only a fewer people have ever invested.

What is financial resilience?

Financial resilience is the ability to withstand life events that affects one’s income and/or assets. It is defined by various variables such as the availability of financial cushion, coping with a financial shortfall and stress, behavioral traits promoting long-term planning and saving, keeping control over money, taking care with expenditure and avoiding financial fraud. Some financially stressful events, such as unemployment, divorce, disability and health problems can seriously affect people individually.

Research by Dr. Sharon Danes, a professor and Extension specialist at the University of Minnesota, found that people’s resilience is enhanced by five characteristics in the face of life’s changes and challenges:

- Positive people view challenges as opportunities and consistently “use lemons to make lemonade.” They tend to be optimistic, to reframe situations positively and they rather see the glass half-full instead of half-empty when comparing their misfortune to others’

- Focused people determine where they are headed in the future and stick to their goals so that life events and other barriers do not deter them

- Flexible people are open to new and different options when faced with uncertainty

- Organized people set priorities and develop structured approaches to manage chang

- Proactive people work with change rather than defend against it

Financial resiliency is also enhanced by various factors like financial resources such as incomes, savings, wealth, health insurance and a payroll. Human capital, which is defined as one’s knowledge, skills, experiences, contacts and other personal qualities, as well as health, affect everyone’s own life, performance and productivity, and also have a strong impact on financial resiliency.

Finally, social capital which includes a support system of family, friends, co-workers and neighbors that can provide emotional and/or financial assistance on a daily basis and even more importantly during hard times, can as well impact financial resiliency very seriously.

Identified vulnerable groups

Strong variations in terms of financial literacy among demographics such as social variables, gender and race have been highlighted.

Social

First, the findings clearly show an educational divide in the achievement of the questionnaire (65% of correct answers for the graduated people vs. 32% for people who did not go to high school). Financial education is clearly associated with greater financial literacy. The household income (61% of correct answers for households income > $100k vs. 32% for <$25k) and the employment situation (53% of correct answers for employed or retired persons vs. 39% for unemployed/disabled persons) appear to be correlated to the financial knowledge as well.

Gender

Secondly, gender is a significant marker which shows strong differences in terms of financial knowledge. Men tend to answer correctly to 55% of the questions while women tend have a score of only 46% of good answers.

Additionally, 24% of men reach the threshold of 22 to 28 correct answers against only 11% of women who show significantly lower financial resilience. Historically restrained access to study, which tends to improve by the time (at least in the developed/developing countries), has strongly impacted elder women in terms of financial literacy, not mentioning financial independence.

Race

Finally, race is as well a strong marker in terms of financial literacy: 37% of correct answers for Black people, 41% for Hispanic people and 55% for white people; and respectively 6%, 8% and 21% of each group reached the threshold of 22 to 28 good answers to the survey.

As always, those identified groups are once again victims of their belonging to a minority. Those variables being not exclusive and the cited minority factors being possibly cumulative, it would be interesting, and most probably dismaying, to evaluate the cumulated minorities-factor-impact.

Main individual key drivers which can increase financial vulnerability

At a personal level, additionally to demographics variables, financial vulnerability may be increased by the following key drivers:

- Health: disabilities or illnesses that affect the capacity to carry out day-to-day tasks

- Life events: major life events such as bereavement, job loss or relationship breakdown

- Resilience: low ability to withstand financial or emotional shocks

- Capability: low knowledge of financial matters or low confidence in managing money (financial capability) and low capability in other relevant areas such as literacy or digital skills

Financial literacy and financial vulnerability: codependent variables

In accordance with what has been previously explained, financial literacy has a direct impact on financial vulnerability. More precisely, the most financially vulnerable subpopulations exhibit the lowest levels of financial literacy, putting them in a challenging position when making complex financial decisions.

Greater financial literacy generally translates into better financial well-being and lower financial literacy is generally associated with lesser financial well-being.

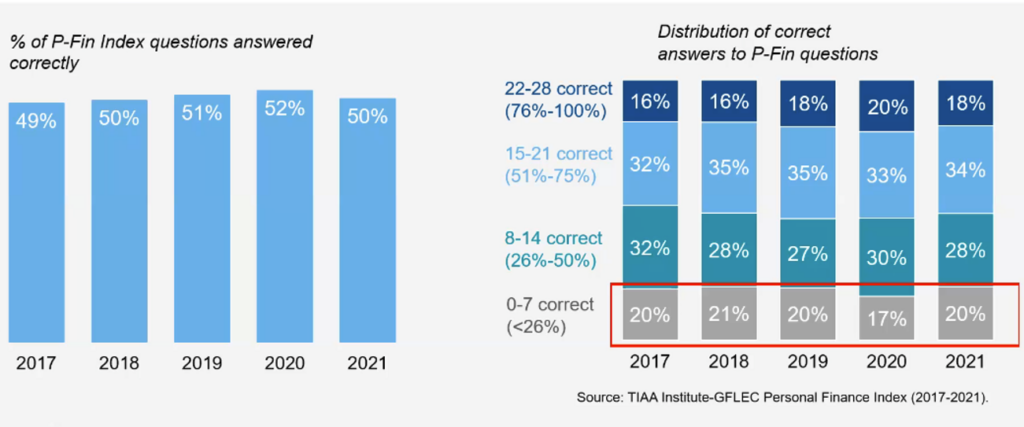

Financial (il)literacy tends to hold steady through the years

This P-Fin index also shows that financial il(literacy) is holding steady through the years. Indeed, the results show that between 2017 and 2021, the level of financial literacy had remained steady with no significant improvement of the global level of financial knowledge.

The Knowledge distribution between the different areas (borrowing vs. comprehending risk) is also holding steady through the years (61% vs. 37% in 2017, 61% vs. 39% in 2021).

Financial literacy, a tool against financial vulnerability

People with low income, who are already the most financially fragile, are even more fragilized by a low general knowledge in finance and thus more financially vulnerable. Studies highlight the importance of financial literacy which is a key component to reduce social inequalities, financially and educationally-wise, and thus to reduce financial vulnerability.

Nonetheless, not only vulnerable groups are affected by a low level of financial knowledge and investors appear not to be totally financially resilient. Among investors, 80% of them think they do not have enough financial knowledge, and 50% of them invest in conservative products due to limited financial knowledge. Investors as well appear not the be perfectly financially literate.

Prior to sell financial products to potential investors, distributors have to make sure their clients know the products they are sold and that they are aware of the risk they are exposed to. For instance in France, the Autorité des Marchés Financiers (AMF) fined 2 million over the past five years due to poor assessment of financial knowledge.

Additionally to this assessment obligation financial products retailers have to fill, several private banking actors already built up finance-educational programs targeting a wide audience in order to foster financial education and to vulgarize finances.

The ESA, during its last conference on this topic underlined the importance to foster financial education of vulnerable groups by developing best practices for national financial education initiatives targeting vulnerable and financially fragile groups.

Pannellists also concluded that financial literacy can be an effetive shield to protect against financial shocks and that everyone, including regulators, banks, pensions, insurers and in particular vulnerable groups would benefit of an improvement of financial education.

EduProfiler: a fun e-learning platform to educate investors

Convinced that gamification is a great tool to democratize the world of investment, we created the EduProfiler, a playful e-learning platform which aims to help potential investors to better understand the different financial products.

Our EDUprofiler educates potential clients, assesses the knowledge of individuals in line with the EU regulatory requirements. EduProfiler also boosts sales of complex products by helping clients better understanding their mechanisms and fills the obligation of compliance.

Are you interested in the possibilities offered by gamification? Request a demo of EduProfiler!