You are a professional investor are offered to invest in different projects in the short term. Bias as the Ellsberg paradox can influence you.

Situation 1

- Investment 1: if an industrial project A is successful, you can reach a profitability €1.1 M. If the project is not successful, you get your money back. You do not lose or win anything. You have no information about the chance of success of the project.

- Investment 2: if an industrial project B is successful, you have 50% chance to reach a profitability of €1M and 50% to get your money back as in the investment 1 (You do not lose or win anything).

Which project do you choose?

Situation 2

- Investment 1: if an industrial project A is not successful, you can reach a profitability €1.1 M. If the project is successful, you get your money back. You do not lose or win anything. You have no information about the chance of success.

- Investment 2: if an industrial project B is successful, you have 50% chance to reach a profitability of €1M and 50% to get your money back as in the investment 1 (You do not lose or win anything).

Which project do you choose?

Most of us choose, in both cases, to invest in the second option with known probabilities of success.

Do you see the contradiction?

We have no information on the industrial project so we need to make hypotheses about the chance of success.

As we are indifferent to bet on the success or on the failure of the industrial project, we can say the probability is 1/2.

If so, we should choose the investment 1 in the first situation since its expected return is higher than the investment 2.

Perhaps we are not so confident in project A and we attribute a lower probability of success, let’s say 40%. In this case, it is rational to choose the investment 1 in the first situation…but not anymore in the situation 2!

In fact, whatever the probability we subjectively attribute to the success of project A, it will be inconsistent to choose in both situations the investment 2.

Ambiguity aversion and neuroscience

This bias is called the uncertainty or ambiguity aversion. It refers to the fact that we try as much as possible to avoid uncertainty.

In behavioral economics, risk refers to a situation where there is a known probability to get A or B (like in investment 2). Uncertainty refers to a situation where there is an unknown probability to get A or B (like in investment 1).

According to some studies in neuroeconomics (Camerer and al,2005), ambiguity aversion is very close to risk aversion except that it implies the part of our brain related to fear (activation of amygdala) contrary to risk aversion, which implies our reward system (striatum activation).

We are risk averse, but we are even more uncertainty averse.

The Ellsberg paradox

In the 1970s, the economist Daniel Ellsberg theorized this ambiguity aversion bias through the famous Ellsberg paradox. The paradox is presented as a game, and it exists in a number of different versions.

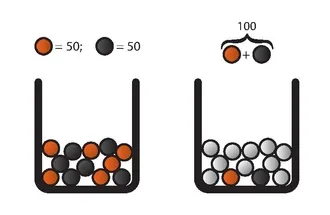

In the most famous version, participants were presented with two fists full of marbles. The right fist contained 50% of red marbles and 50% of black marbles.

The left fist contained an unknown quantity of red marbles and an unknown quantity of black marbles. Invariably, when given a choice of which fist they wanted to pick either a red or a black marble out of, they chose the right fist. On the surface, making the choice that offers a 50/50 chance seems obvious. In reality, one is just as likely to pick the correct-colored marble from the left fist, with an unknown mix of marbles.

Applications to finance

Ambiguity aversion affects our daily decisions and in particular our financial decisions. We tend to avoid investing in something we do not understand and whose probability of failure or success is hard to estimate. We are also more confident to invest in something we have the impression to know better.

In finance, this can lead us to invest in domestic markets or in sectors we are more familiar with. This specific behavior is called home bias and affect professional as well as retail investors.

References

Hsu M, Bhatt M, Adolphs R, Tranel D, Camerer CF (2005): Neural systems responding to degrees of uncertainty inhumandecision-making. Science 310:1680 –1683.

88. Huettel SA, Stowe CJ, Gordon EM, Warner BT, Platt ML (2006): Neural signatures of economic preferences for risk and ambiguity. Neuron 49:765–775.

Cognitive Biases, Ambiguity Aversion and Asset Pricing in Financial Markets

Elena Asparouhova, Peter Bossaerts, Jon Eguia, and Bill Zame‡