What are ESG ratings? And why do they often seem to be disconnected from reality?

- In November 2022, after the decision of the Colombian Ministry of Labor to open an investigation against Teleperformance, the share price of the French call center company fell by 34%.

- In January 2022, Orpea’s share price fell following revelations on the group’s practices.

In both cases, the companies were given good, or even very good ESG (Environment, Society, Governance) ratings. Within the world of CSR, scandals involving companies considered as exemplary are accumulating. In 2010, it was the case of BP before the explosion of its oil rig Deepwater Horizon [1]. In 2015, it was also the case of Volkswagen before the “Dieselgate” scandal [2].

You will find the answer to these questions in this article.

What is an ESG rating?

An ESG rating is a score, often in the form of letters (AAA, B+, etc.), which claims to represent the overall performance of a company – most often a listed company – in three areas: environment, society and governance. They are issued by ESG rating agencies such as MSCI, ISS, Vigeo Eiris or Sustainalytics. To be more precise, these agencies rate by “pillar” – an E rating, an S rating and a G rating.

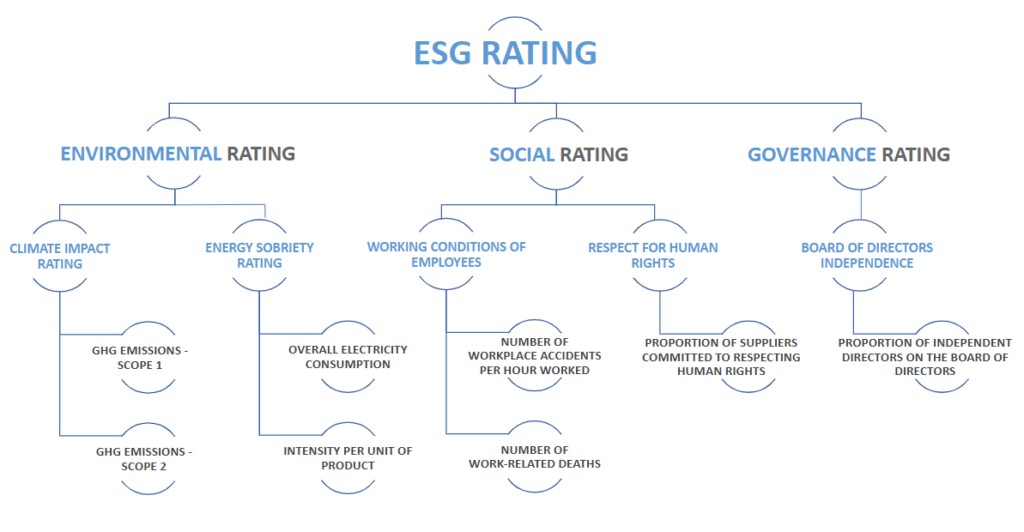

In practice, to make these scores, the agencies base their ratings on a set of indicators. For example:

- Scope 1 greenhouse gas emissions are an environmental indicator

- The rate of workplace accidents per hour worked is a social indicator

- The percentage of independent directors is a governance indicator

These indicators are then grouped by sub-category and used to determine intermediate scores. For example, one could imagine that scope 1 GHG emissions are used to determine a “Climate Impact” score. Or that the work accident rate is taken into account in a “Working conditions” score. Once the scores for each sub-category have been determined, it remains to decide on a weighting for each of them in their respective pillar. This results in an environmental rating, a social rating and a governance rating. By assigning a weighting to each of these pillars once again, we finally obtain an overall ESG rating.

Different methodologies for ESG ratings

We have seen that ESG ratings are weighted averages of various indicators. This aggregation practice can be criticized in itself because it leads to questionable equivalences. For example, how can a company justify offsetting an increase in workplace accidents with a decrease in GHG emissions?

Moreover, the rating agencies themselves tend to disagree with each other on these equivalence relationships, and these disagreements lead to recurrent criticism – ESG ratings diverge depending on the issuing agencies [3].

In other words, the same company can be rated very well by one rating agency and very poorly by another at the same time. Below, we try to explain that a large part of these divergences in results actually come from differences in methodology.

The choice of indicators

The first element on which the methodologies of the rating agencies diverge concerns the selection criteria for the indicators of interest. Indeed, depending on the sector of activity of the company being evaluated, the indicators to be selected are not the same.

For example, indicators relating to consumer health will be considered more important in a company in the food industry than in a company in the IT sector. For each sector, the rating agencies must therefore give their opinion on the materiality of the indicators. This is what MSCI does in its “ESG Industry Materiality Map” [4].

However, there is no consensus on the notion of materiality of ESG issues. While most rating agencies favor “financially relevant” risks, i.e. a single materiality approach, Europe puts forward the double materiality approach.

“MSCI’s ESG ratings assess the resilience of companies to long-term, financially relevant environmental, social and governance risks.”

Choosing weights for ESG ratings

Once the indicators of interest have been determined, it is then necessary to decide how they will influence the final rating.

In practice, this is done by assigning a weighting to each indicator in the final score. Once again, however, the assignment of this weighting is subject to debate. For example, how can one decide on the relative importance of biodiversity versus gender equality? Most rating agencies answer this question with simple materiality: The more likely an ESG risk is to materialize financially, the more important it is, and therefore the higher the weighting in the final rating. We return once again to the debate on double materiality.

Managing the lack of transparency

Finally, a major problem for ESG rating agencies is the lack of transparency of the companies evaluated on material issues.

Indeed, an ESG indicator that is considered material and that is the subject of a significant weighting in the final rating may not be revealed by the evaluated company. The practice to be adopted in this case is, once again, subject to debate. In such circumstances, some agencies choose to give the median rating, while others choose to give the lowest rating in order to penalize the company for its lack of transparency.

Financial or non-financial ratings?

It is common to refer to ESG ratings as extra-financial ratings. This is the terminology used by the French Ministry of the Economy [5]. However, as we have just seen, the majority of ESG ratings are made by taking into account only financially relevant indicators. In practice, they are therefore financial risk ratings.

This observation raises a problem. If ESG ratings, and the underlying ESG indicators, do indeed reflect financial risk, then this implies that conventional financial statements are not exhaustive. If they are not, i.e. if ESG ratings report on a financial risk that is already accounted for in financial statements, then they are useless because they simply repeat information that already exists.

Conclusion on ESG ratings

ESG ratings are scores that claim to represent the overall performance of companies on all social, environmental and governance issues.

In practice, the majority of them only take into account financially relevant risks. As a result, a gap with the real social and environmental risks tends to be created, and is materialized at the time of various scandals (Orpéa, Téléperformance, etc).

Therefore, the name “extra-financial rating” should be questioned, since ESG ratings are in fact designed to reflect a financial risk. This raises another problem. If ESG ratings are used to identify financial risks, this means that financial statements are not exhaustive. If they are not, it means they are useless.

At Neuroprofiler, we offer both a tool to collect investors’ ESG preferences and a financial education platform to better understand sustainable finance topics. A combined use of these two modules allows to set investors sustainability preferences and to better understand the sustainable investment choices available.

Please feel free to make an appointment to learn more about our solutions.

Ressources

[1] Reuters Events, Beyond petroleum: Why the CSR community collaborated in creating the BP oil disaster https://www.reutersevents.com/sustainability/stakeholder-engagement/beyond-petroleum-why-csr-community-collaborated-creating-bp-oil-disaster

[2] Harvard Law School Forum, Ratings that Don’t Rate: The Subjective World of ESG Ratings Agencies https://corpgov.law.harvard.edu/2018/08/07/ratings-that-dont-rate-the-subjective-world-of-esg-ratings-agencies/

[3] SSRN, Aggregate Confusion: The Divergence of ESG Ratings https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3438533

[4] MSCI, ESG Industry Materiality Map https://www.msci.com/our-solutions/esg-investing/esg-industry-materiality-map

[5] Faciléco – Ministère de l’Économie et des Finances et de la Souveraineté Industrielle et Numérique, La notation extra-financière https://www.economie.gouv.fr/facileco/notation-extra-financiere#:~:text=Les%20agences%20de%20notation%20traditionnelles,environnementaux%20ou%20sociaux%20des%20entreprises.