Younger and younger equity investors…

In its July 2023 “lettre de l’observatoire de l’épargne“, the AMF (Financial Markets Authority in France) notes a rejuvenation of equity investors, initiated during the Covid 19 crisis.

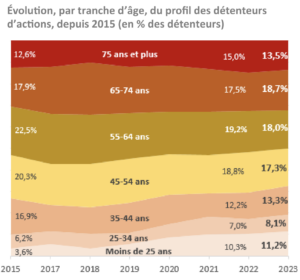

While half of all shareholders are still over 55, the proportion of young shareholders (under 35) has risen from 7.6% in 2018 to almost 20% in the first half of 2023. The overall rate of equity investors, meanwhile, has remained stable at around 6%. At the same time, the shareholding rate of the over-45s has fallen.

Almost 40% of new equity investors are under 35. Even more surprisingly, the under-25s hold more shares than the 25-35s. The under-25s will hold 11.2% in 2023, compared with 8.1% for the 25-35s!

These data come from daily transaction reports sent to the AMF. These are the mandatory MiFIDII reports sent by investment service providers.

represent 11.2% of the individual shareholder population

and those aged 35-34, 8.1%.

Source: SoFia survey, Kantar, March 2023

Increasingly responsible investors…

While interest in responsible investment remains moderate among the French population, it is high among young investors. Since 2022, they have accounted for half of all new subscribers to sustainable financial products, according to a study carried out by Opinionway for the Autorité des marchés financiers (AMF).

According to the AMF letter, 58% of under-35s are interested in sustainable finance. More of them (42%) have a good image of it than the over-65s (24%), and plan to invest part of their savings in it in the short or medium term (44%, versus 15%). Half of all new investors in responsible funds are under 35. This interest seems even more pronounced among young women.

These results are in line with a Neuroprofiler 2022 study. It shows that 80% of people under 40 want to have an impact through their investments. By contrast, the figure is only 60% for older people.

The need for better financial education for young people

Young French people’s new enthusiasm for equity investing and sustainable finance is good news for economic development and social and environmental protection. However, it must be accompanied by appropriate financial education!

Indeed, the excesses of certain trading applications aimed at a young audience. One example that quickly springs to mind is the Robinhood app in the USA.

The latter has been criticized for encouraging excessive speculation. In particular, the use of gamification elements such as confetti animations when executing an order. The gamified practices of the app and the possibility of having a large overdraft on the app were even blamed in 2020 for the suicide of a 20-year-old trader. He had incurred over $700,000 in debt on the app.

Meanwhile, financial authorities are constantly raising the alarm about online scams and fake sites. They promise enticing investments, including sustainable ones, and young investors are particularly hard hit.

France lags behind in financial education

To avoid these abuses, good financial education remains essential. Yet France is far from a model in this respect. According to the 2016 Allianz study “Money, financial culture and risk in the digital age”, France ranks last in financial culture out of 10 European countries, behind Portugal and Italy. On the other hand, Austria, Germany and Switzerland top the ranking.

Just under half of French respondents were able to answer questions on inflation and interest rates. The study also shows that the Millenials generation (born in the 1980s and 1990s) has the lowest level of financial literacy.

According to the July 2023 AMF letter, the lack of financial education also concerns sustainable investment topics. Individuals, including young people, feel they have too little knowledge on the subject to judge the true sustainability of the investments they are offered.

Aware of these limitations, in 2023 the French market authority stressed the importance of financial education for young people. It emphasized its desire to multiply initiatives on the subject.

“This new generation of retail investors is an asset for the Paris financial center,” says AMF Chairman Marie-Anne Barbat-Layani. “The AMF will continue its educational initiatives to help shareholders, especially novices of all ages, acquire a stock market culture with a long-term perspective.

Influencing young people in the right direction…

In March 2023, with an accessible style and modern aesthetic, the AMF published a guide to employee savings. This partnership with Les clés de la finance aims to encourage young people to save for retirement.

The AMF and ARPP are launching the Responsible Influence in Finance certificate in September 2023. Generation Z young people (under 25) have become very sensitive to influencers. Particularly on the social networks TikTok, YouTube or Instagram. According to a 2023 AMF analysis, 11% of investors today get their information from influencers on social networks, most of whom are under 25. According to a 2022 Neuroprofiler survey, the new Generation Z would even trust influencers more than bankers!

Yet, despite their aura, their financial education often remains limited. They therefore represent both a real opportunity to educate young investors… but also a real risk if the information transmitted is erroneous.

The AMF certificate of responsible influence in finance

Aware of this problem, the AMF hopes to professionalize this activity and protect young investors with this “certificate of responsible influence in finance“. To date, this certificate has been awarded to almost 1,000 French influencers.

The course covers investment products, different types of services and financial providers. The two authorities also detail the rules to be respected when communicating about an investment offer, specifying the products and services whose advertising is prohibited. A minimum of 75% correct answers to 25 multiple-choice questions are required to validate this certificate.

An alternative approach to effectively educating the younger generation about finance, as yet little exploited by financial regulators, is that of gamification. Indeed, this technique can also facilitate learning if used wisely.

Numerous publications, including from regulators such as Consob in Italy, have demonstrated the effectiveness of this learning method for financial subjects.

These studies show that gamification enables long-term memorization of financial principles. In particular, by encouraging young investors to return regularly to a learning platform. Rewards, surprise effects and micro-learning are just some of the ways in which gamification stimulates engagement.

An effective approach to educating young investors… and their influencers!