Context of the guidelines publications

Asking investors about their preferences for sustainable investing has become part of the routine for financial advisors and asset managers since the 2nd of August.

This new rule will apply under Insurance Distribution Directive (IDD) and under Markets in Financial Instruments Directive (MiFID) (see related Delegated Regulation). This means it will apply both for banks, wealth management companies and insurance companies.

How to define a sustainable investment?

The regulator defines the notion of sustainable investment as a financial instrument which is aligned with at least one of the three criteria below:

- a financial instrument that is invested in environmentally sustainable investments, as defined in Article 2(1) of Regulation (EU) 2020/852 of the European Parliament and f the Council, in a minimum proportion determined by the client or potential client

- a financial instrument which is invested in sustainable investments within the meaning of Article 2(17) of Regulation (EU) 2019/2088 of the European Parliament and the Council in a minimum proportion determined by the client or potential client

- a financial instrument that addresses key adverse impacts on sustainability factors, with the qualitative or quantitative elements that demonstrate this being determined by the client or potential client.

Documents published by the authorities

On the 27th of January 2022, the European Securities and Markets Authority (ESMA) published a consultation paper to propose guidelines on how to incorporate sustainability preferences assessment in the client suitability process. The consultation closed on 27 April 2022 and the final report is expected for Q3 2022.

On the 13th of April 2022, the European Insurance and Occupational Pensions Authority (EIOPA) similarly launched a public consultation on draft “Guidelines on integrating the customer’s sustainability preferences”. The submission deadline was on the 13th of May 2022.

On the 20th of July 2022, the European Insurance and Occupational Pensions Authority (EIOPA) published a guidance on this subject and decided to pause its work on Guidelines on the topic of sustainability preferences in order to gather more information based on the implementation experience with the new legislative framework.

The guidance is complemented by a feedback statement, which addresses the comments received from stakeholders in the public consultation on draft Guidelines on integrating the customer’s sustainability preferences.

Challenges regarding the implementation of the assessment of sustainability preferences

This publication was particularly expected since the implementation of this regulation raises many challenges.

Challenge 1: Lack of data about products

Data about the points a, b and c (Taxonomy, Principal Adverse Impacts…) will be available only in January 2023 for most products.

This means that, before this date, the matching between products and the client’s ESG profile will be difficult. In many cases, clients will have to modify their sustainable preferences to be allowed to invest.

Challenge 2: Limited ESG offer

For many financial institutions, the ESG offer is still limited to Article 8 products (products with a moderate ESG impact). They do not have products aligned with the taxonomy. If they have, the percentage of alignment is often limited to 5%-20%.

Since the assessment of sustainability preferences should be “unbiased” as specified many times in the guidelines, many clients may not be aware of the market situation and may want a very high alignment to the Taxonomy (80% and more).

This means, again, that, most of the time, no suitable products will be found and clients will have to modify their sustainability preferences to be allowed to invest. This may generate frustrations and deter clients from investing in ESG products in the future.

Challenge 3: Impact on the process of the financial institutions

The addition of the assessment of sustainability preferences will have a strong impact on the IT and compliance processes of financial institutions. The current matching process is often based on one single dimension (risk), while this new regulation implies to implement a multi-criteria matching (risk, taxonomy and SFDR alignment, PAI).

Challenge 4: Financial education of clients and advisors

Finally, the level of financial literacy regarding sustainable investments is very low both among clients and advisors. The new regulation is very technical, using complex terms like taxonomy, SFDR, Principal Adverse Impacts… with complex underlying definitions.

Challenge 5: Lack of clarity of the text and previous guidelines

Finally, on top of the inherent complexity of the regulation, some concepts and processes were not clearly defined and sometimes contradictory from the ESMA to the EIOPA version (ex: inclusion of Taxonomy aligned products in SFDR aligned products, qualitative or quantitative elements which should be gathered for each PAI…).

What do the new EIOPA guidelines imply?

The new guidelines are not fundamentally different from the draft published in Spring. We summarize below the main differences.

More educational guidance

First, the guidance is much clearer than the first version of the EIOPA guidelines. It is illustrated by useful charts and graphs. Terms and wordings are less ambiguous and more pragmatic. This is especially the case for the definitions of points a, b and c.

EU Taxonomy: is a classification system which establishes a list of environmentally sustainable economic activities. That Regulation does not lay down a list of socially sustainable economic activities. Sustainable investments with an environmental objective might be aligned with the Taxonomy or not.

Sustainable investment: means an investment in an economic activity that contributes to an environmental or social objective, provided that the investment does not significantly harm any environmental or social objective and that the investee companies follow good governance practices.

Principal adverse impacts: are the most significant negative impacts of investment decisions on sustainability factors relating to environmental, social and employee matters, respect for human rights, anti-corruption and anti-bribery matters.

Acknowledgment of the difficulties to implement the new regulation

Second, the guidance recognizes that the implementation of the regulation is tricky given the different deadlines of the regulations. They however do not give much more flexibility to financial institutions, which will have to make their “best efforts” to implement the regulation in August, even if product data is not yet fully available.

Important regulatory initiatives are still ongoing to identify and properly disclose investments in sustainable economic activities, including under the EU Taxonomy. These disclosures are crucial for insurers and insurance intermediaries to assess whether the products offered match the sustainability preferences of customers.

Some of the rules are not yet finalised and the implementation of these initiatives do not converge at the same points in time, in particular the application date of the new legislation under the IDD precedes the deadlines for reporting of company data under the Corporate Sustainability Reporting Directive and of the application of the Delegated Regulation supplementing the Sustainable Finance Disclosure Regulation.As a result, insurers and insurance intermediaries need to responsibly disclose on sustainability, based on the data currently available and make best efforts to ensure good data quality.

Guidance on the integration of sustainability preferences in the suitability assessment under the Insurance Distribution Directive (IDD), July 2022

More flexibility regarding the position of the section about sustainability preferences assessment

In both ESMA and EIOPA first draft guidelines, it was recommended to position the section about the assessment of sustainability preferences at the end of the suitability questionnaires. The new guidance gives more flexibility.

For the purpose of a suitability assessment, it is important that insurers and insurance intermediaries obtain information on sustainability preferences in the course of the collection of information on investment objectives and this may be collected as the last element within the collection of information on investment objectives.

However, in the latter case, this should not prevent the customer, at his/her own initiative, from bringing up their sustainability preferences in an earlier part of the information collection.

Guidance on the integration of sustainability preferences in the suitability assessment under the Insurance Distribution Directive (IDD), July 2022

List of Principal Adverse Impacts

Moreover, a categorization of Principal Adverse Impacts is clearly suggested: environment, employee matters, respect for human rights, anti-corruption and antibribery matters. It was not the case in the first ESMA/EIOPA draft guidelines.

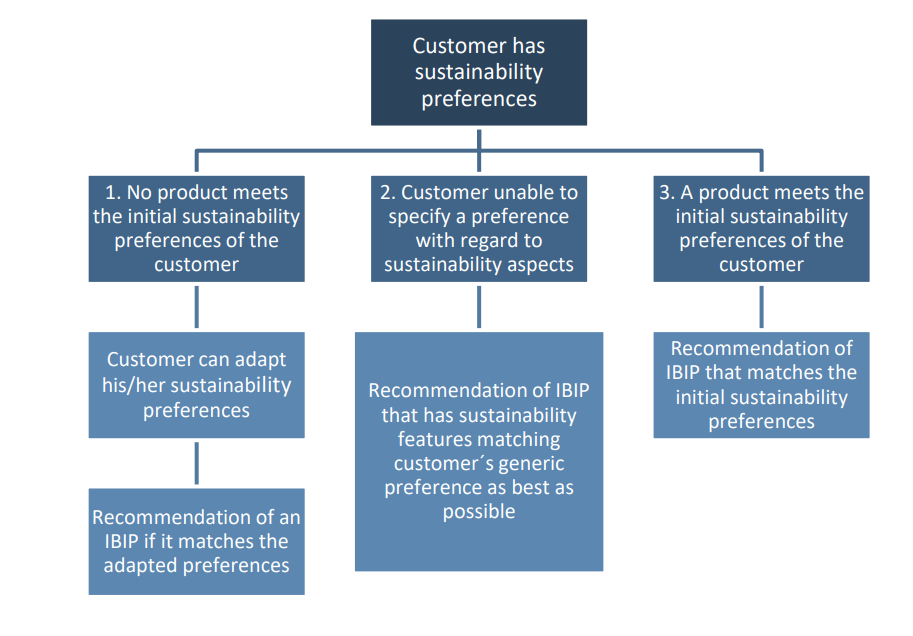

Process when a client has sustainability preferences, but does not want to share his/her preferences

The guidance gives more details on the situation where clients share they have ESG preferences, but are not willing to give more details about their appetence for a, b or c.

This situation may be quite common since clients may be reluctant to take a long questionnaires assessing their ESG preferences using technical terms like taxonomy, PAI, SFDR… after a suitability questionnaire which already quite long and laborious.

In this case, the insurer should ask additional questions to the client to check he/she has really no specific preference regarding points a), b) or c). If the client maintains his/her position, the insurer or insurance intermediary can still recommend an IBIP that has sustainability features matching the customer’s preferences as best as possible, taking into account the sustainability preferences as expressed by the customer in general terms.

In that case, the insurers and insurance intermediaries should record in a suitability statement:

- A description of the customer’s sustainability preferences, even if in broad or general terms;

- The fact that even though the customer has sustainability preferences, he/she has not specified a preference with regard to any aspect(s); and

- If a personal recommendation of an IBIP is made based on the customer’s sustainability preferences, the reasons underlying that personal recommendation.

Process when no products match the client’s sustainability preferences

Given the challenges mentioned earlier, it will be very common that no products match the exact sustainability preferences of the client.

This will be especially the case regarding the alignment to the Taxonomy, where many clients may want to have a high alignment to the Taxonomy, while current available products on the market often have a maximum alignment of 20%.

Previously, the guidelines were asking to the financial institutions to make the clients retake the questionnaire to adapt their sustainability preferences. Given the very high number of possible combinations of a, b and c, this would have implied to take the questionnaires a lot of times until finding the exact combination corresponding to products available at the financial institution.

In this guidance, the EIOPA adopts a more pragmatic approach. The financial institution will have the option to show to the clients the products which the highest alignment with their ESG preferences, and ask them if they are open to modify them in order to invest.

What happens if the product invested in does not match the customer’s sustainability preferences including due a change in the customer’s sustainability preferences?

The insurer or insurance intermediary should:

- Inform the customer;

- Evaluate the impact of this change;

- Inform the customer in an updated suitability report, and

- Make a new recommendation where required by national rules or where it provided for under the contract.

(…) When a customer decides to adapt its preferences, the insurer or insurance intermediary could for example disclose to the customer information about the products integrating sustainability preferences that are the closest to the preferences expressed by the customer available in the market and/or by the insurer or insurance intermediary providing the advice.

How does this guidance impact the Neuroprofiler InvestProfiler?

Neuroprofiler has adapted its ESGprofiler accordingly.

The InvestProfiler is an investment game based on behavioral finance which assesses client’s sustainability preferences in an interactive and educational way, in line with the new European regulations